Choosing the right business structure is a key step toward financial success. If you’re deciding between registering as a sole proprietor or forming a corporation, this article breaks down the key tax advantages of each. We’ll also show you a quick comparison table, answer your most common questions, and invite you to book a free 15-minute consultation to help you choose the best path forward.

📊 Quick Comparison: Tax Benefits Overview

| Feature | Sole Proprietor | Corporation |

|---|---|---|

| Tax Rate | Personal (up to 53%) | Small business rate (9–15%) |

| Income Splitting | ❌ Not allowed | ✅ Possible with dividends |

| Business Expense Deductions | ✅ Yes | ✅ Yes |

| Carry Forward Losses | ❌ Limited | ✅ Up to 20 years |

| Retained Earnings | ❌ Not possible | ✅ Can defer personal tax |

| Tax Credits | Limited | Access to SR&ED & others |

| Investor Credibility | Low | High |

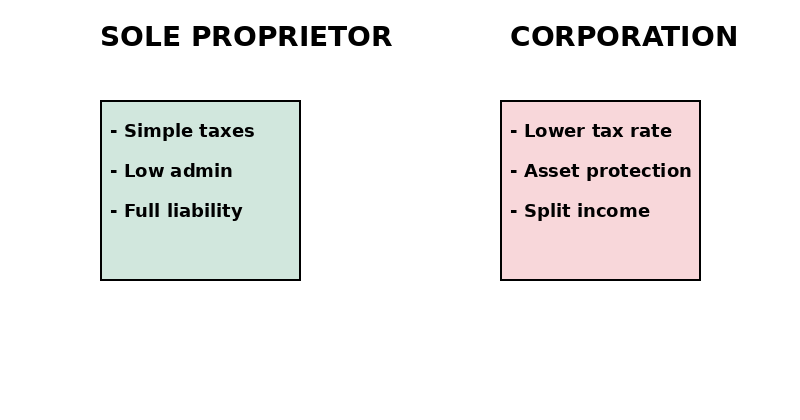

✅ Pros & Cons: Sole Proprietor vs. Corporation

| Aspect | Sole Proprietor | Corporation |

|---|---|---|

| Advantages |

|

|

| Disadvantages |

|

|

🕒 When Should You Consider Incorporating?

- 📈 Your business earns more than $60,000/year

- 👥 You plan to hire employees or add partners

- 🧾 You want to retain profits in the business

- 🛡️ You need liability protection for personal assets

- 💼 You’re applying for financing or grants

- 🚀 You’re planning to grow or scale operations

If two or more of these apply, incorporation could be the smarter move.

❓ FAQs – Frequently Asked Questions

1. Is it true that corporations pay less tax than sole proprietors?

Yes. In Canada, small business corporations often pay a much lower tax rate (around 9–15%) on the first $500,000 of active income, compared to personal tax rates for sole proprietors which can reach over 50%.

.

2. What is income splitting and how does a corporation help?

Income splitting allows a corporation to pay dividends to a spouse or adult children (shareholders), spreading the income and reducing the overall tax burden. Sole proprietors cannot do this legally unless the family members work in the business.

3. Can I leave money inside the business as a sole proprietor?

No. All business income is treated as personal income and taxed accordingly. Corporations can retain earnings and defer personal taxes.

4. Are business expense deductions the same for both?

Generally, yes. Both structures can deduct legitimate business expenses. However, corporations may access additional tax credits and deductions, such as scientific research and experimental development (SR&ED) credits.

5. Do I need to file separate taxes as a corporation?

Yes. A corporation must file its own corporate tax return (T2), separate from your personal return. Sole proprietors report business income on their personal tax return using Form T2125.

📣 Take the Next Step — Book Your Free 15-Minute Consultation

Not sure if incorporating is right for you?

Let us help you make the smartest move for your business