When we help newcomers to Canada file their taxes, it’s common for them to receive a follow-up letter from the Canada Revenue Agency (CRA). One of the documents often included is Form RC151. This form is used by the CRA to verify previous income outside of Canada, especially for spouses or partners who haven’t yet filed a Canadian tax return.

In this guide, we’ll explain what Form RC151 is, who receives it, and how to complete it step by step. If you (or a client) have received this form, keep reading to learn exactly what you need to do.

What is Form RC151?

Form RC151 – GST/HST Credit Application for Individuals Becoming Residents of Canada is a document issued by the Canada Revenue Agency (CRA). It is used to determine if a newcomer to Canada qualifies for the Goods and Services Tax/Harmonized Sales Tax (GST/HST) credit.

The GST/HST credit is a tax-free quarterly payment that helps individuals and families with low or modest incomes offset some of the sales taxes they pay on goods and services. Newcomers who become residents of Canada and wish to apply for this credit must complete Form RC151 and submit it to the CRA.

This form collects essential information about your residency status and income to assess your eligibility. Since newcomers may not yet have filed a Canadian tax return, the CRA uses this form as an alternative method to evaluate whether they qualify for the credit.

You may receive Form RC151 if

You recently moved to Canada and became a resident for tax purposes.

You want to apply for the GST/HST credit but haven’t filed a tax return for the previous year.

The CRA needs to verify your status and income to determine your eligibility for benefits.

Submitting this form ensures that newcomers do not miss out on financial support that they may be entitled to as part of Canada’s tax and benefit system.

🧾 Things You Should Have Ready Before You Start

Before filling out Form RC151, make sure you have the following documents and information on hand:

✅ Personal Information

Your Social Insurance Number (SIN)

Your full name and date of birth

Your complete Canadian address (including postal code)

✅ Date of Arrival in Canada

The exact date you entered Canada (e.g., January 10, 2024)

✅ Income Before Arriving in Canada

The total amount you earned outside of Canada from January 1 up to the day before your arrival

You can use pay stubs, bank statements, or make a reasonable estimate

If the income was in another currency, it’s recommended to convert it to Canadian dollars (CAD)

✅ Information About Your Spouse or Common-law Partner (if applicable)

Full name, SIN (if available), and date of birth

Date of arrival in Canada

Income earned outside of Canada during that same period

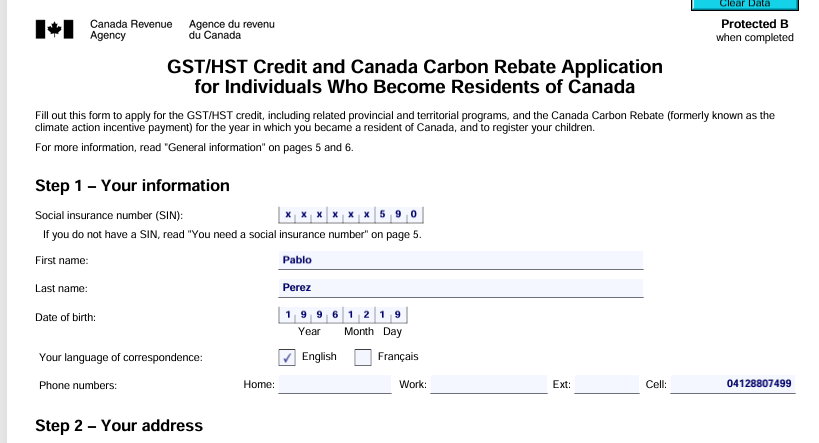

🧍♀️ Step 1 – Personal Information

Start by filling out your personal details at the top of the form. This includes:

Your full legal name (as it appears on official documents)

Your Social Insurance Number (SIN)

Your date of birth

Your current mailing address in Canada, including your apartment number (if applicable), city, province, and postal code

Your telephone number, in case the CRA needs to contact you

📝 Tip: Make sure this information matches exactly what you’ve provided in other applications to avoid delays.

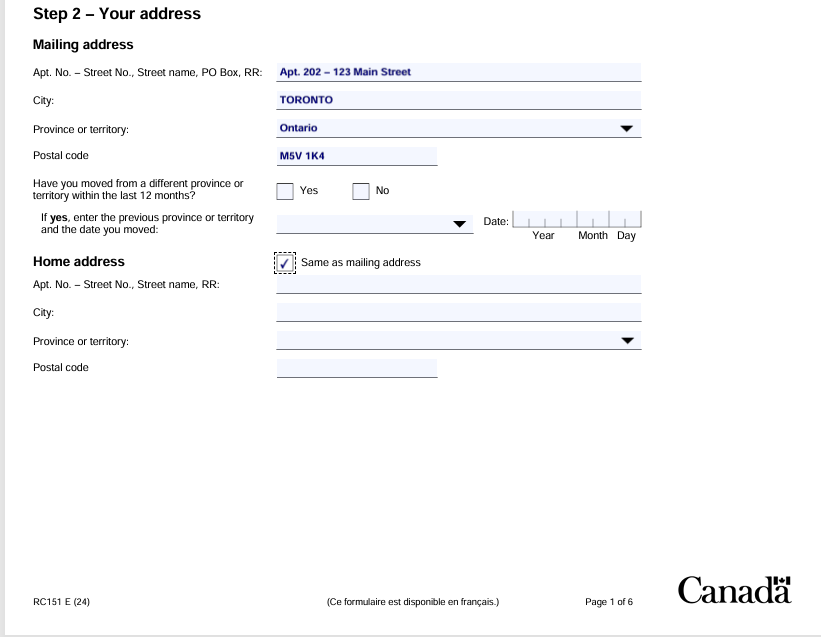

🏠 Step 2 – Your Address

In Part 2 of the form, you’ll need to enter your complete mailing address in Canada. This includes your street number and name, city, province, and postal code.

If you moved from another province or territory within the last 12 months, make sure to check the corresponding box and provide:

The previous province or territory, and

The date of your move

In the “Home address” section:

If your residential address is the same as your mailing address, simply check the box that says “Same as mailing address”.

If it’s different, you must enter your full current residential address separately.

📝 Tip: Double-check your postal code and make sure all address details are accurate to avoid processing delays.

💍 Step 3 – Your marital status

In Part 3 of the form, you must select your marital status at the time you became a resident of Canada.

In this example, the option “Single” is selected because the person is not married or in a relationship.

If this doesn’t apply to you, and you are married or in a common-law relationship, you must also provide the following information about your spouse or partner:

Their Social Insurance Number (SIN)

Their full legal name

Their date of birth

Their address (only if it’s different from yours)

📝 Note: Providing complete and accurate information about your marital status helps the CRA assess your eligibility for benefits more efficiently.

🏠 Step 4 – Your Residency Status

This section is used to inform the CRA when you (and your spouse or partner, if applicable) became residents of Canada for the first time, or when you returned as residents after living abroad.

💡 Important:

Being a resident for CRA purposes means that you live and establish ties in Canada—not just that you are physically present in the country.

📝 Tip: If your spouse or partner became a resident on a different date than you, make sure to enter both dates accurately.

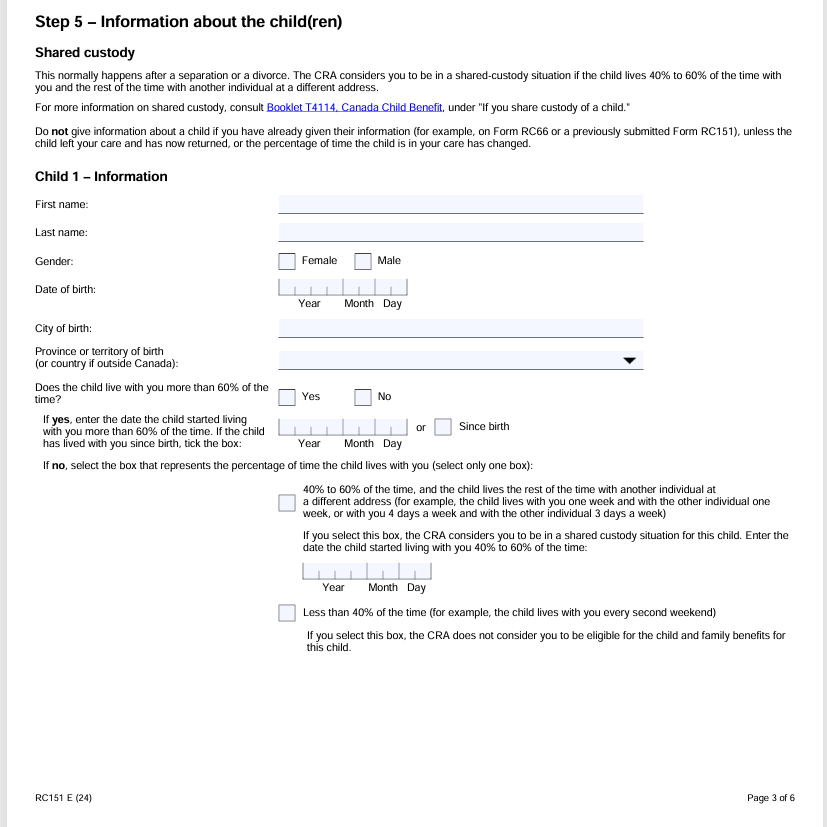

👶 Step 5 – Information About the Child

This section should only be completed if you have children in your care. You must provide information for each child, especially if you are applying for benefits such as the Canada Child Benefit (CCB).

In this example, since there are no children in care, this section is left blank.

📝 Note: Only fill out this part if you are responsible for one or more children living with you in Canada.

💰 Step 6 – Your Income

In this section, you must report any income that you (and your spouse or partner, if applicable) earned outside of Canada. The CRA needs this information to calculate the benefits you may be eligible for, such as the GST/HST Credit.

✅ All amounts must be converted to Canadian dollars (CAD) using the Bank of Canada’s exchange rate at the time the income was received.

Refer to: bankofcanada.ca/rates/exchange

🔹 A – The year you became a resident of Canada

Enter the year you became a resident of Canada.

👉 Example: 2024

Then, report the income earned from January 1 of that year up to the day before your arrival in Canada.

In this example, the income earned outside Canada before arriving was $1,250 CAD.

📌 If you had no income during that period, you must write “0”.

🖊️ Final Section – Declaration and Signature

This is the final section of Form RC151, and it is mandatory for your application to be valid. Here, you are declaring that all the information you provided is true and complete.

🔹 What do you need to do?

Your signature

Sign your legal name, exactly as it appears on the form.

Date (Year / Month / Day)

Write the date you are signing the form.

🧑🤝🧑 If you have a spouse or common-law partner:

They must also sign and date in the space provided, if their information was included on the form.

⚠️ Important Notes:

If the form is not signed, it will be rejected by the CRA.

Electronic signatures are not accepted. If the form is printed, it must have a handwritten signature.

Once signed, your form is complete ✅

📩 Step 8 – Where to Send It

Depending on your province or territory of residence, you must mail Form RC151 to the correct CRA tax centre. Below are the mailing addresses according to your location in Canada:

If you live in:

New Brunswick, Newfoundland and Labrador, Nova Scotia, Ontario, or Prince Edward Island:

Send your form to:

Sudbury Tax Centre

Post Office Box 20000, Station A

Sudbury ON P3A 5C1

Canada

If you live in:

Alberta, British Columbia, Manitoba, Northwest Territories, Nunavut, Quebec, Saskatchewan, or Yukon:

Send your form to:

Winnipeg Tax Centre

Post Office Box 14001, Station Main

Winnipeg MB R3C 3M3

Canada

📝 Reminder:

Make sure you send your completed and signed form to the correct address to avoid delays in processing your application.

✅ Conclusion

Completing Form RC151 is an important step for newcomers to Canada who want to access tax benefits like the GST/HST Credit. While the form may seem a bit overwhelming at first, breaking it down step by step—and preparing the required information in advance—can make the process much easier.

By providing accurate details about your residency, income, and marital status, you help the Canada Revenue Agency (CRA) determine your eligibility for important financial support.

Remember to sign the form by hand, and send it to the correct tax centre based on your province of residence.

If you’re unsure about anything, don’t hesitate to reach out to a tax professional or community support service that helps newcomers. Submitting a complete and correct form ensures faster processing and helps you receive the benefits you’re entitled to.