🧾What Happens If the CRA Audits You?

If you’re a small business owner in Canada, especially within the Latino communityyou may feel nervous hearing from the Canada Revenue Agency (CRA). But don’t panic. This guide is here to help you understand what a CRA audit is, why it happens, and how you can prepare with confidence.

With the right steps, documents, and mindset, you can navigate any CRA audit and come out stronger.

🔟-Step CRA Audit Survival Guide for Entrepreneurs

Being audited by the CRA doesn’t mean you did something wrong it means it’s time to prove your records are in order. Whether you’re a freelancer, a small business owner, or just starting out, these 10 practical steps will help you:

Understand what to expect from a CRA audit

Get your documents and mindset ready

Avoid common mistakes that lead to penalties

Know your rights and how to protect your business

Let’s break it down so you can face the audit process with confidence and come out stronger on the other side.

✅ 1. Understand Why You're Being Audited

The CRA selects businesses for audit due to:

Unusual tax deductions

Income discrepancies

Random selection

Industry targeting

📝 Tip: If you’re self-employed or deal in cash-heavy services (e.g., food, cleaning, construction), you’re more likely to be audited.

✅ 2. Stay Calm and Review the Audit Letter

The CRA will send you an audit notice. It may request:

Specific tax years

Types of income or expenses

Access to records

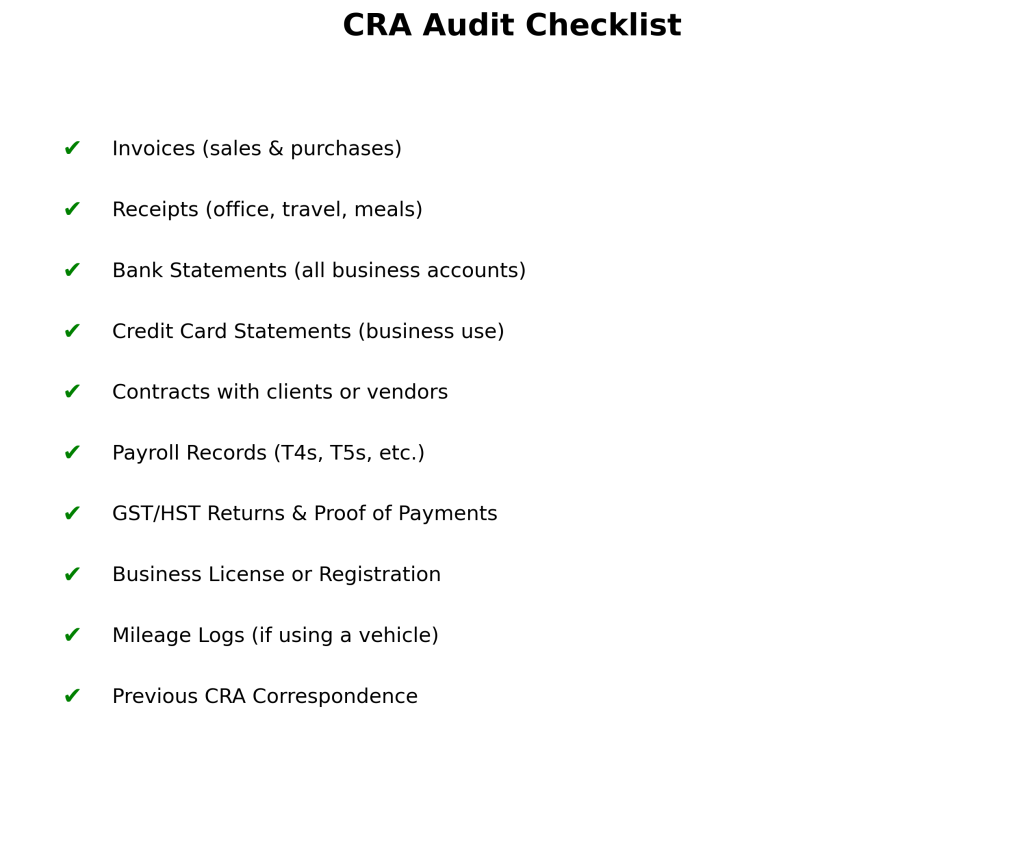

✅ 3. Gather and Organize Key Records

✅ 4. Separate Business and Personal Finances

Many Latino entrepreneurs start small and use the same bank account for personal and business. That’s risky.

Open a dedicated business bank account and credit card to avoid confusion.

✅ 5. Work with a Bilingual Accountant or Tax Professional

Language barriers during an audit can cause stress. If English isn’t your first language, seek bilingual support many CRA representatives or accounting firms offer Spanish-speaking services.

🎯 Bonus tip: Practice answering basic audit questions in both languages if needed.

✅ 6. Respond Promptly but Carefully

You typically have 30 days to respond. Don’t delay.

Avoid these mistakes:

Submitting incomplete records

Guessing numbers

Being defensive or overly casual

✅ 7. Learn About Your Rights

You can:

Request clarification

Appeal decisions

Ask for more time

Use CRA’s Taxpayer Bill of Rights to understand your protections.

✅ 8. Prepare for In-Person or Virtual Interviews

Auditors may visit your home, business, or set up a Zoom call. Be professional and polite.

✅ 9. Understand "Indirect Verification" Techniques

The CRA may estimate income based on:

Bank deposits

Lifestyle (net worth reviews)

Industry averages

If you’re audited using these, you’ll need extra documentation to explain gaps.

✅ 10. Learn from the Experience

Even if no errors are found, use the audit as a chance to improve your business recordkeeping and legal compliance.

Why the CRA Might Audit You – And What You Can Do About It

| 🚨 Why the CRA May Audit You | ✅ What You Can Do |

|---|---|

| Unreported cash income | Declare all income, even cash, and keep written logs |

| High or suspicious deductions | Ensure deductions are valid, documented, and business-related |

| Late or missed tax filings | File on time, or request an extension before the deadline |

| Business and personal expenses mixed | Use separate accounts/cards and keep itemized records |

| Frequent changes in income year over year | Attach explanations to your tax return when applicable |

| Large charitable donations not matching income | Keep receipts and ensure donations match your financial profile |

| Unclaimed foreign income | Report all global income; consult a tax expert for cross-border rules |

| Random CRA selection | Stay ready: keep your records organized year-round |

| Industry flagged for audit (e.g., cash-heavy sectors) | Use digital payment options and track all cash transactions |

| CRA received a third-party tip or complaint | Ensure full transparency and have supporting evidence |

📣 Ready for a CRA Audit? Let SU Consulting Help You Prepare with Confidence

❓ Frequently Asked Questions (CRA Audit FAQ)

Yes. Many CRA audits are random or triggered by industry trends. Being audited doesn’t mean you did something illegal it just means they want to verify your information.

Usually 4 years, but if the CRA suspects fraud, misrepresentation, or gross negligence, they can go back even 6+ years.

The CRA may disallow any expense you can't support. Try to recover receipts, use bank or credit card statements, and include notes or logs explaining the expense.

Not legally, but it’s highly recommended especially if you don’t fully understand the process or have complex finances. A professional can speak directly with the CRA on your behalf.

Some common triggers include:

High deductions that don’t match your income

Unreported income (especially cash)

Missing tax filings

Operating in high-risk or cash-heavy industries

Yes, you can ask the CRA for more time but do it as soon as possible and explain your reason. Delays without notice may hurt your case.

You have the right to file a formal objection within 90 days of receiving your notice of assessment. You can also appeal to the Tax Court of Canada if needed.

No, a CRA audit alone does not affect your credit score or immigration. But unpaid taxes or legal action from the CRA might have consequences if left unresolved.

📘 Glossary of CRA Audit Terms for Entrepreneurs

Understanding these common terms will help you navigate a CRA audit with more confidence, especially if English is not your first language.

- CRA (Canada Revenue Agency):

- The federal agency responsible for tax collection, audits, and benefit distribution in Canada.

- Audit:

- A formal review of your financial records by the CRA to verify the accuracy of your tax filings.

- Notice of Audit:

- The official letter sent by the CRA informing you that your tax return is being reviewed.

- Tax Return:

- The annual report of your income, deductions, and taxes filed with the CRA.

- Supporting Documents:

- Receipts, contracts, bank statements, and other files that prove the accuracy of your return.

- Deduction:

- Expenses related to your business that you can subtract from your income to reduce your taxable amount.

- Self-Employed:

- Someone who works for themselves (freelancer, contractor, small business owner).

- Net Worth Audit:

- A method where the CRA estimates your income based on your lifestyle and assets.

- Taxpayer Rights:

- Legal rights that protect you during CRA audits, including the right to appeal and be treated respectfully.

- Business Number (BN):

- A unique identifier for your business used by the CRA to track taxes, GST/HST, and payroll.