ROE Form: Step-by-Step Instructions to Fill It Out Without Mistakes

The ROE (Record of Employment) is an official document that employers in Canada must issue when an employee experiences an interruption in earnings. It is used by Service Canada to determine if a person qualifies for Employment Insurance (EI) benefits.

STEP-BY-STEP GUIDE TO FILLING OUT THE FORM

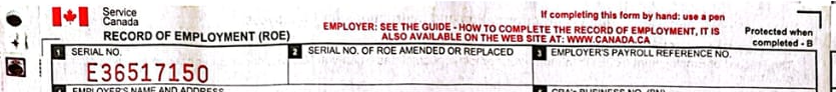

Box 1. Serial Number: Each paper ROE has a pre-printed serial number. If you’re using a paper ROE, the serial number will already appear in this box.

Note: When using an electronic ROE, the system automatically assigns the number when the ROE is submitted to Service Canada.

Box 2. Serial Number of the Amended or Replaced ROE: This box is only completed if you are making changes to the original ROE form or if you are issuing a replacement.

Box 3. Employer’s Payroll Reference Number (optional): This field is optional. You may enter the payroll reference number assigned to the employee in your payroll system.

Box 4. Employer’s Name and Address:

Enter the full name of the business or employer, along with the complete mailing address (including city and province).

Box 5. CRA Business Number (BN):

This is the employer’s account number registered with the Canada Revenue Agency (CRA). It usually follows the format of nine digits followed by two letters and four numbers (e.g., 123456789RP0001).

Box 6. Pay Period Type:

Indicate the frequency with which the employee was paid: weekly, bi-weekly, semi-monthly, monthly, etc. (e.g., Weekly, Bi-weekly, Semi-monthly, Monthly).

Box 7. Postal Code:

Enter the employer’s postal code as it appears in the address.

Box 8. Social Insurance Number (SIN):

Enter the employee’s Social Insurance Number. This number is required to process Employment Insurance (EI) benefit applications.

Box 9. Employee’s Name and Address:

Include the employee’s full name (first and last name) and complete address (street, city, province, and postal code).

Box 10. First Day Worked (or first day worked since last ROE issued):

Specify the first day the employee worked or the first day worked since the last ROE was issued, in Day/Month/Year format.

Box 11. Last Day for Which Paid:

Enter the last date the employee received payment for work performed. This may differ from the last actual day worked if there were unpaid days.

Box 12. Final Pay Period Ending Date:

Enter the date on which the last pay period ended before issuing the ROE. This date may be different from the last day the employee worked.

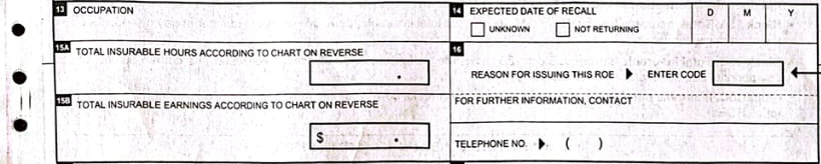

Box 13. Occupation:

Enter the job title or main occupation the employee held at the time of separation from employment. Be as specific as possible (e.g., Cashier, Forklift Operator, Administrative Assistant).

Box 14. Expected Date of Recall:

If the employee is expected to return to work, enter the exact return date (in Day/Month/Year format).

If the return date is unknown, check the box marked “Unknown.”

If the employee is not returning, check “Not Returning.”

Only one option must be selected.

Box 15A. Total Insurable Hours According to Chart on Reverse:

Enter the total number of insurable hours worked by the employee during the relevant period. These hours are used to determine eligibility for Employment Insurance (EI) benefits. Refer to the chart on the back of the ROE for correct calculation.

Box 15B. Total Insurable Earnings According to Chart on Reverse:

Enter the total dollar amount of the employee’s insurable earnings, as calculated using the chart on the back of the form. Be sure to include all types of insurable remuneration (wages, bonuses, overtime, etc.).

Box 16. Reason for Issuing this ROE – Enter Code:

Indicate the code corresponding to the reason for issuing the ROE. Common examples include:

A: Shortage of work (end of contract or layoff)

D: Illness or injury

E: Quit

M: Maternity

Refer to the official list of ROE codes to ensure the correct one is selected.

Box 15C. Insurable Earnings by Pay Period:

Enter the insurable earnings for each individual pay period.

The column labeled “P.P.” represents the pay period number, starting with the most recent (1) and going backward, up to a maximum of 27 periods.

In the corresponding columns, record the amount earned in each pay period.

This helps Service Canada accurately calculate Employment Insurance (EI) benefits.

Box 17. Only Complete if Payments or Benefits Were Issued:

Fill out this section only if the employee received additional payments other than regular wages, either at termination or afterwards.

A. Vacation Pay:

Indicate if accumulated vacation pay was issued, and enter the amount.B. Statutory Holiday Pay:

If the employee was paid for statutory holidays, include the dates (D/M/Y) and amounts paid.C. Other Monies – Specify:

Specify any other payments (e.g., severance, bonuses, gratuities), list the amounts, and clearly describe the type of payment on the provided line.

Box 18. Comments:

This is an optional field used only if there’s relevant information to clarify about the ROE, such as special circumstances, notes about payment or date discrepancies, or any helpful context for Service Canada.

Box 19. Complete Only if Payment Was Made for Illness, Maternity, etc.:

Fill out this section only if the employee received payment after the last day worked under any of the following categories:

Illness or injury

Maternity or parental leave

Compassionate or family care leave

Wage loss insurance benefits

You must enter:

The start date of the payment

The total amount received

Indicate whether it was a daily or weekly payment

Box 20. Communication Preferred In:

Check the box to indicate the employee’s preferred language for communication: English or French.

Box 21. Telephone Number:

Enter the employer’s contact phone number so Service Canada can reach out if further information is required.

Box 22. Certification and Signature:

The person authorized to issue the ROE must:

Sign the form

Print their name clearly

Enter the date of issuance (Day/Month/Year)

By signing, the issuer certifies that all information provided is true and complete.

Submitting false information is considered an offense.

📞 Need help with your ROE or payroll?

At Cofianna, we make sure your ROE is filed correctly and your payroll runs smoothly.